Everything about fairfax bankruptcy attorney

Step 7 – Discharging the Bankruptcy – For those who have a Chapter seven bankruptcy in Fredericksburg, the trustee will make a decision whether you have house that is really worth seizing to provide and shell out creditors. Should you have a Chapter thirteen bankruptcy, you might ship the trustee all your disposable monthly cash flow still left right after paying out your home costs.

Filing bankruptcy is really a lawful course of action. Until you know what you happen to be undertaking and also have expertise with the procedure, you may inadvertently make really serious blunders in your filing files.

For the next 3 to five years, you’ll pay back your trustee and they'll distribute money for your creditors. You are able to’t consider out new debt without your trustee’s authorization even though less than your repayment plan. You’ll must Dwell inside a spending plan, due to the fact your disposable cash flow will go towards financial debt.

There are two “commitment durations” for Chapter 13 – three a long time or 5 years. In case your income is higher than the median money in your state, your payment program have to be for five years.

Should your scenario is dismissed, you may not get the security of the automatic remain in the event you file more instances in a person yr.

Chapter thirteen can also help you save your property from foreclosure. You will, having said that, should catch pop over to this site up on your delinquent payments through your repayment approach.

You should not deliver any delicate or private information and facts via This great site. Any info sent by means of This website doesn't produce an attorney-shopper partnership and may not be handled as privileged or confidential.

can finest analyze the main points about your scenario and give you good, lawful steerage. Under a Chapter thirteen bankruptcy, you can keep your residence but will have to prepare a payment intend to repay all or many of your debts inside a a few (three) to five (five) yr interval. view it now Primarily, you will end up reorganizing your financial debt into debts that will be compensated and debts which will be discharged.

It normally takes as much as seventy five times to the court docket to approve your Chapter 13 bankruptcy situation. When you’re accredited, Website you’ll have 3 to five years to repay your eligible financial debt.

In that period of time, unforeseen scenarios can lead to you not being able to find the money for look at here now the payments. A health care situation, job decline, or almost every other read review situation over and above your Manage can arise.

Consolidating might also preserve you dollars on desire if you’ve improved your credit history score given that having out your authentic loans. Also, personal debt consolidation loans normally feature lessen charges than credit cards.

Every person who data files for Chapter 13 bankruptcy must engage in a pre-bankruptcy counseling course. You are going to get a certification of completion, which you need to involve together with your paperwork when you file.

If you need to get a motor vehicle during your repayment approach, the very best solution would be to buy a lower-Expense car in cash. Remember that the higher interest fees you should deal with when financing throughout your bankruptcy would increase both of those the whole cost of the auto, and also the regular payments.

Look at consulting an attorney for this portion. It’s important to get all this information right.

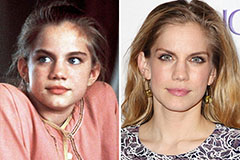

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Shannon Elizabeth Then & Now!

Shannon Elizabeth Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!